Financial Momentum in Your 40s and 50s: Build the Retirement You Actually Want

Most men hit their 40s carrying the weight of two decades of “supposed to” — supposed to have saved more, supposed to understand investing better, supposed to feel more secure. Here’s what nobody tells you: the game isn’t over. In fact, these years are when smart strategy beats early starts every single time.

The Hard Truth About Mid-Career Financial Planning

Financial planning for men in their 40s and 50s retirement ready ?

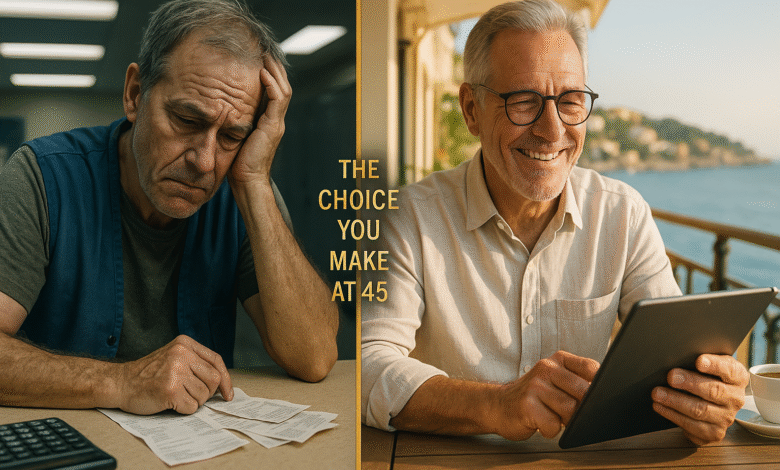

You’re earning more than ever. You might finally feel like you’ve “made it.” But here’s the uncomfortable reality: many men in their 40s and 50s face unique financial pressures including aging parents, children’s education expenses, and their own approaching retirement.

The margin for error is shrinking. But so is the noise.

You don’t need another generic retirement calculator telling you to “save 15%.” You need a strategic framework built for where you actually are — not where some financial guru thinks you should be.

Reality Check: Most financial advice treats your 40s and 50s as damage control. That’s backward thinking. These are your leverage years — when experience meets income meets clarity of purpose.

Why This Decade Demands a Different Approach

The Triple Convergence

Three forces collide in your 40s and 50s:

- Peak earning years — You’re finally making real money

- Compressed timeline — Retirement is visible on the horizon

- Maximum complexity — Kids, aging parents, mortgages, careers all demand attention simultaneously

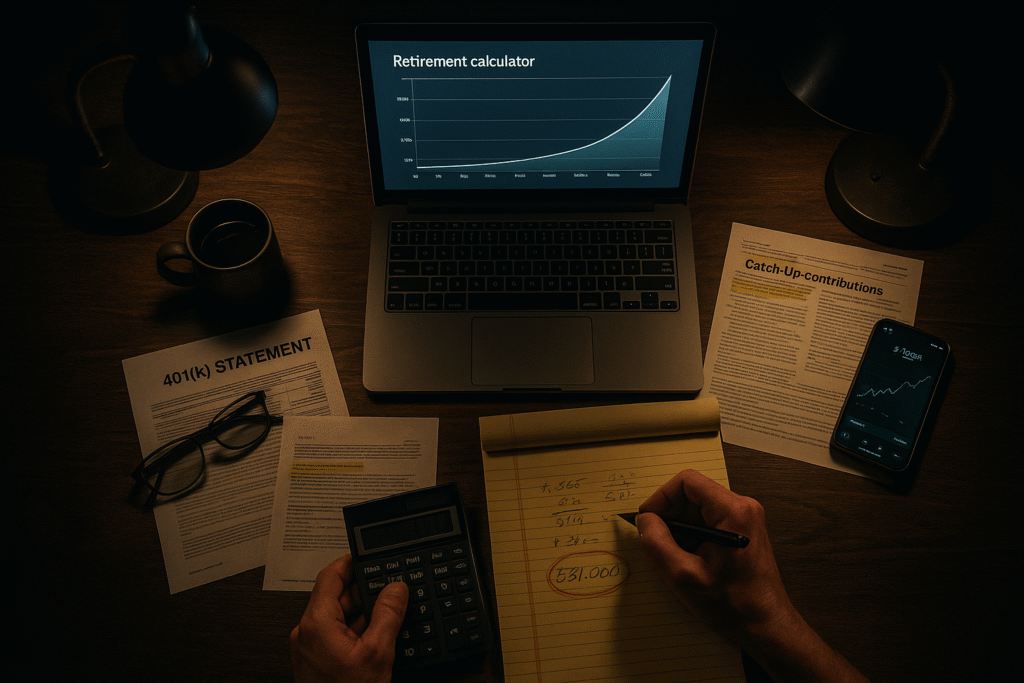

Starting at age 50, you can take advantage of “catch-up” contributions that allow you to save significantly more in retirement accounts. This isn’t consolation for lost time — it’s strategic acceleration.

Breakthrough Tip: The men who retire comfortably don’t have perfect track records. They have aggressive final-decade strategies.

The Foundation: Know Your Numbers (No Denial Allowed)

Before strategy comes truth.

The Retirement Savings Benchmark Reality

Financial experts recommend having saved approximately 3 times your annual salary by age 40 and around 6 times your salary by age 50.

Not there? You’re not alone. And you’re not doomed.

But you do need to get brutally honest about three numbers:

- Current retirement savings (all accounts combined)

- Monthly disposable income (after essential expenses)

- Realistic retirement age (not when you want to retire — when you actually can)

Work with online calculators or consult a financial advisor to get a clear, realistic picture of your current financial situation and expected retirement lifestyle. The discomfort of knowing beats the disaster of guessing.

Strategy 1: Weaponize Your Retirement Contributions

Stop contributing what feels comfortable. Start contributing what creates momentum.

Max Out Everything (Seriously)

Maximize contributions to 401(k) plans and IRAs, as these accounts offer tax advantages that can significantly enhance your retirement savings.

Action Step:

- Under 50: Contribute the maximum to your 401(k) ($23,500 in 2025)

- Over 50: Add catch-up contributions (additional $7,500) for a total of $31,000

- IRA contributions: $7,000 standard, plus $1,000 catch-up if 50+

Can’t max out immediately? Increase contributions by 2% every six months. You won’t feel the incremental pinch, but your future self will feel the compound impact.

Truth Over Tact: If you’re getting a tax refund, you’re doing it wrong. That money should be pre-tax retirement contributions, not an interest-free loan to the government.

Strategy 2: Kill Your Debt Like It’s Threatening Your Family

Because it is.

Eliminating high-interest debt frees up significant funds for saving and investing, with priority given to credit card debt and personal loans that carry the highest interest rates.

The Debt Elimination Hierarchy

- Credit cards — Attack these first with extreme prejudice

- Personal loans — Secondary target

- Mortgage — If on track with other goals, consider making extra principal payments to shave years off the loan

Hard Truth: Every dollar paying 18% credit card interest is a dollar not earning 8-10% in the market. That’s not just a 18% loss — it’s a 26-28% opportunity cost. Monthly.

Breakthrough Tip: Automate extra debt payments the day after payday. Willpower is a finite resource. Systems beat intentions.

Strategy 3: Build a Fortress (Not Just a Safety Net)

Establish an emergency fund covering 6-12 months of essential expenses to safeguard against unforeseen events.

This isn’t paranoia. It’s tactical defense against life’s absolute certainty: unexpected problems arrive on their own schedule.

Why the Emergency Fund Matters More Now

In your 20s, you could recover from financial setbacks with time. In your 40s and 50s, setbacks compound. A six-month job search doesn’t just cost six months of income — it can derail decades of retirement planning if you’re forced to liquidate investments during a down market.

Build and maintain an emergency fund covering 3 to 6 months of expenses to handle unexpected costs without derailing your savings.

Reality Check: If tapping your 401(k) for an emergency ever crosses your mind, your emergency fund isn’t large enough. Period.

Strategy 4: Insurance — Protect What You’ve Built

Assess your life, health, and disability insurance policies to ensure they align with your current needs and provide adequate protection for your family.

You’re not buying insurance. You’re buying the peace of mind that your family won’t experience financial devastation alongside personal tragedy.

The Insurance Reality Matrix

- Life insurance: Should cover 10-12x your annual income

- Disability insurance: Replaces 60-70% of income if you can’t work

- Long-term care: Plan for future healthcare expenses by exploring long-term care insurance options

Hard Truth: Most men are underinsured precisely when their families depend on them most. Review coverage annually, especially after major life changes.

Strategy 5: Healthcare Planning — The Silent Wealth Destroyer

Plan for healthcare costs including premiums, Medicare gaps, and potential long-term care expenses.

Healthcare in retirement can consume 20-30% of your budget. Ignore it now, suffer later.

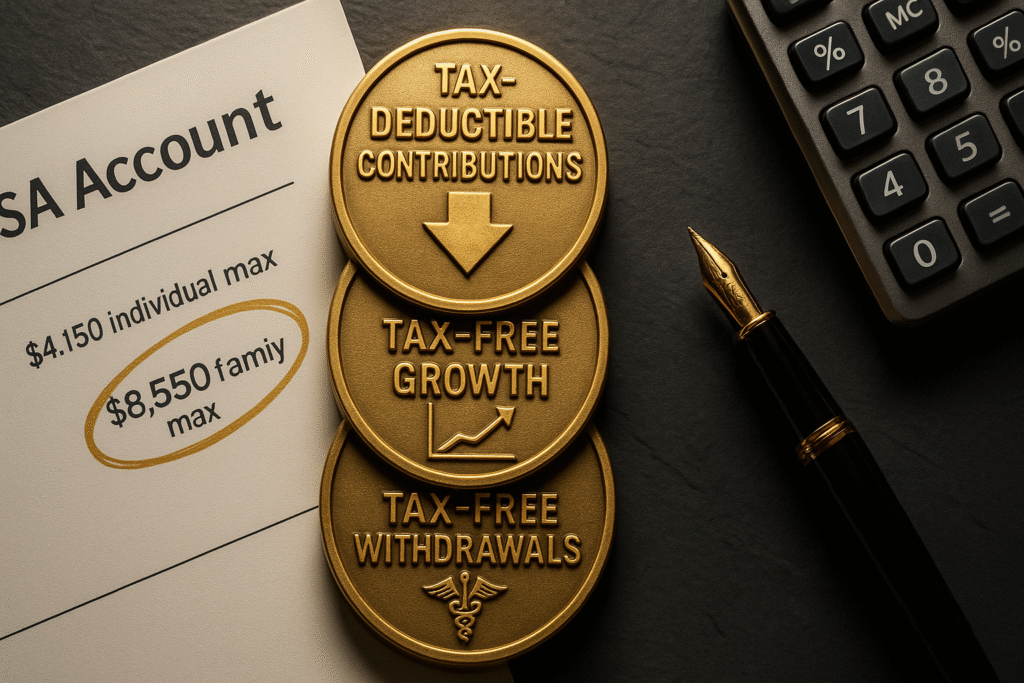

The HSA Triple Tax Advantage

Health Savings Accounts offer triple tax advantages: contributions are tax-deductible, funds grow tax-free, and withdrawals for medical expenses are tax-free.

Think of your HSA as a stealth retirement account for healthcare. Max it out ($4,300 individual, $8,550 family in 2025, plus $1,000 catch-up at 55+), invest the funds, and let it compound for medical expenses in retirement.

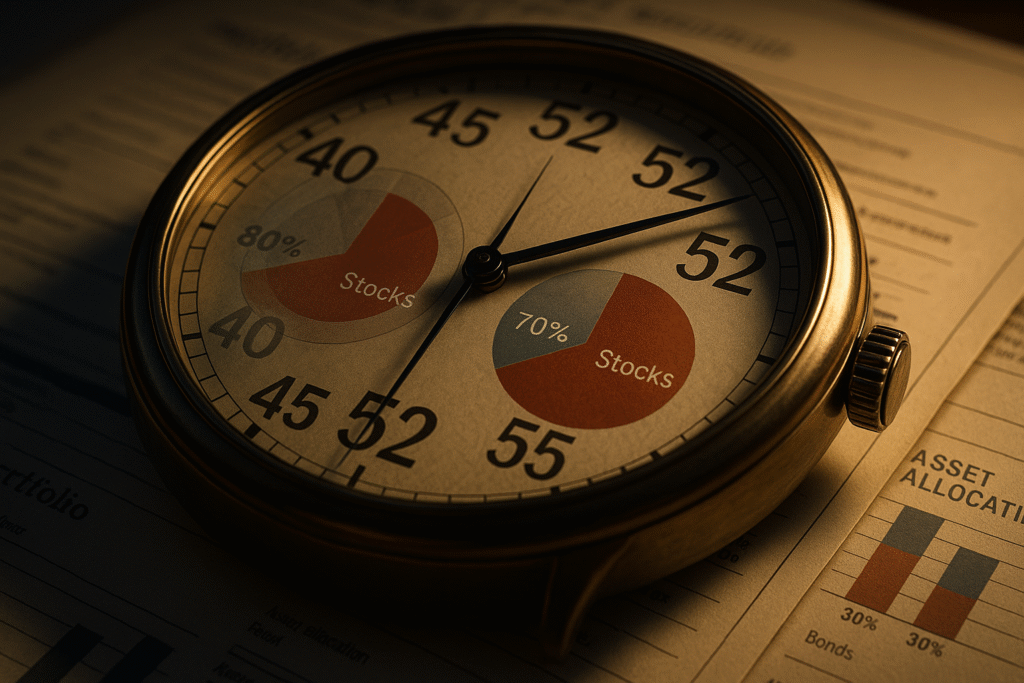

Strategy 6: Investment Strategy — Sophistication Over Aggression

Ensure investments are diversified across various asset classes to mitigate risk, gradually incorporating more conservative assets as you approach retirement.

You’re not 25 anymore. Pure growth investing with 100% stocks made sense then. Now you need strategic allocation.

The Glide Path Approach

In Your 40s:

- 70-80% stocks (growth focus)

- 20-30% bonds (stability foundation)

In Your 50s:

- 60-70% stocks (balanced growth)

- 30-40% bonds (increasing protection)

Diversify investments and reassess risk exposure as you get closer to retirement to protect accumulated wealth while still seeking growth.

Competence Signal: Professional investors don’t try to time the market. They systematically rebalance quarterly, selling high-performers to buy undervalued assets. This forces disciplined buying low and selling high.

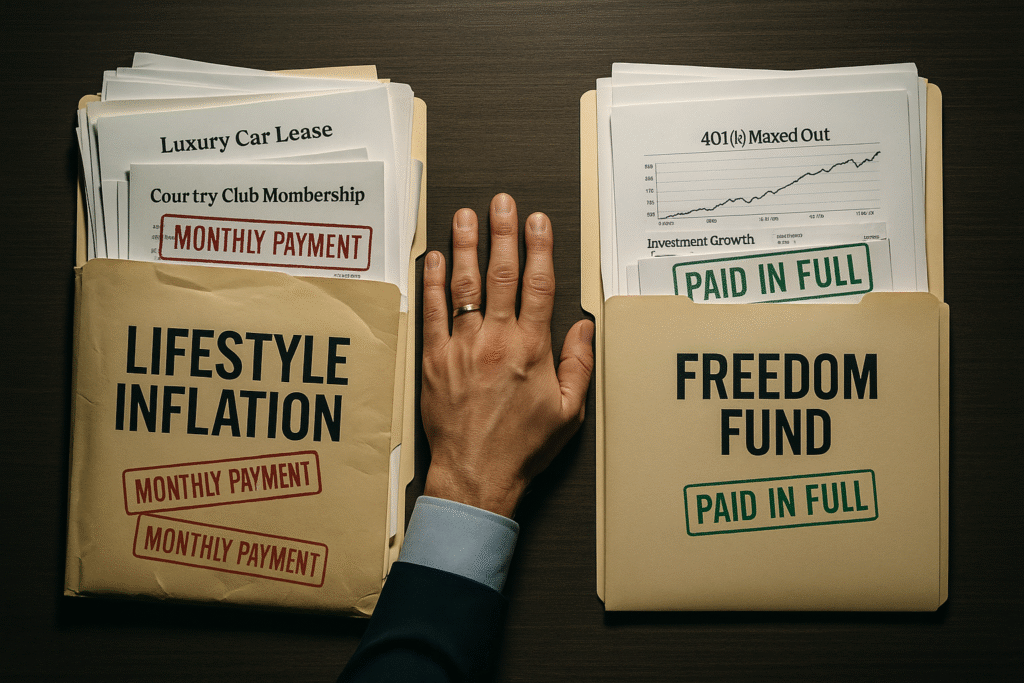

Strategy 7: Resist Lifestyle Inflation (The Silent Dream Killer)

Avoid lifestyle inflation by resisting the temptation to increase spending in line with income growth, instead channeling additional income into savings and investments.

You finally make six figures. Congratulations. Now comes the real test: keeping your lifestyle at $80K while banking the difference.

Truth Over Tact: The luxury car lease, the bigger house, the country club membership — these aren’t rewards for success. They’re obstacles to freedom. Every ongoing expense is a monthly vote against early retirement.

Action Step: When you get a raise, immediately increase retirement contributions by 75% of the raise amount. Live on 25% of the increase. You’ll never miss it.

Strategy 8: Get Professional Guidance (But Choose Wisely)

Engaging a fee-only financial advisor can provide personalized guidance tailored to your financial goals and circumstances.

Your financial situation is more complex than it was at 30. Meeting with a financial professional can help optimize tax planning, Social Security benefits timing, and estate plans.

The Advisor Selection Framework

Look for:

- Fee-only compensation (no commissions = no conflicts of interest)

- Fiduciary duty (legally obligated to act in your best interest)

- CFP certification (rigorous training and ethical standards)

Reality Check: If an advisor guarantees returns or pushes specific products, run. Real advisors build strategies, not sales pitches.

The Contingency Plan: What If You’re Behind?

Let’s address the elephant: What if you’re 50 with minimal savings?

Consider delaying retirement if savings are insufficient. Working 2-3 extra years accomplishes three things simultaneously:

- More years of contributions

- More years of compound growth

- Fewer years drawing down savings

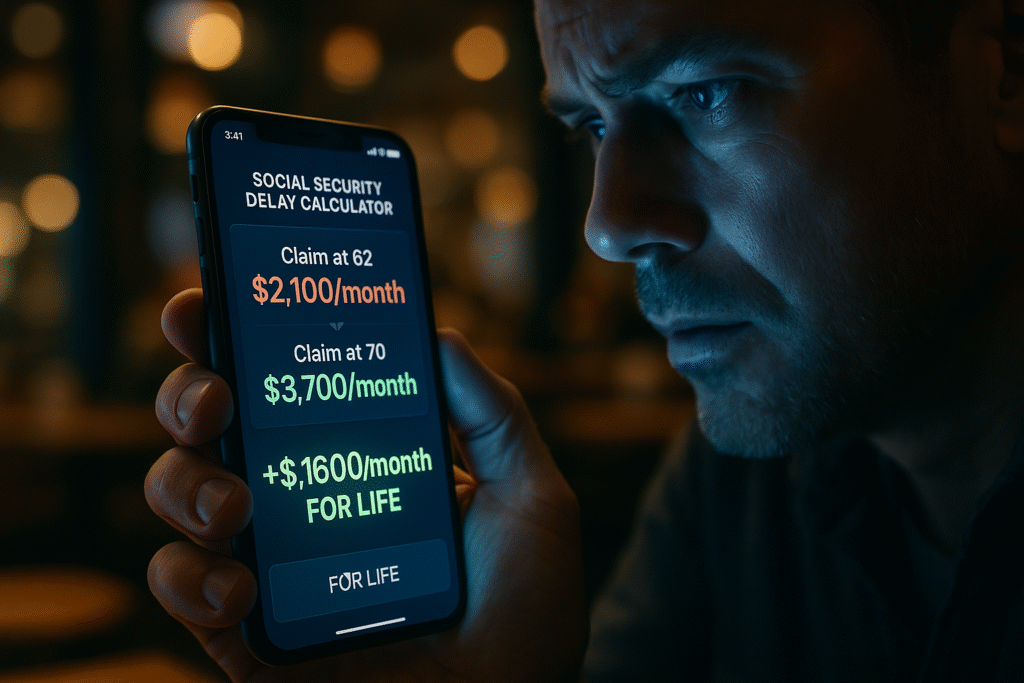

Breakthrough Tip: Every year you delay Social Security past full retirement age (up to age 70) increases your benefit by approximately 8%. That’s a guaranteed 8% annual return — better than most investments.

Estate Planning: Protect Your Legacy

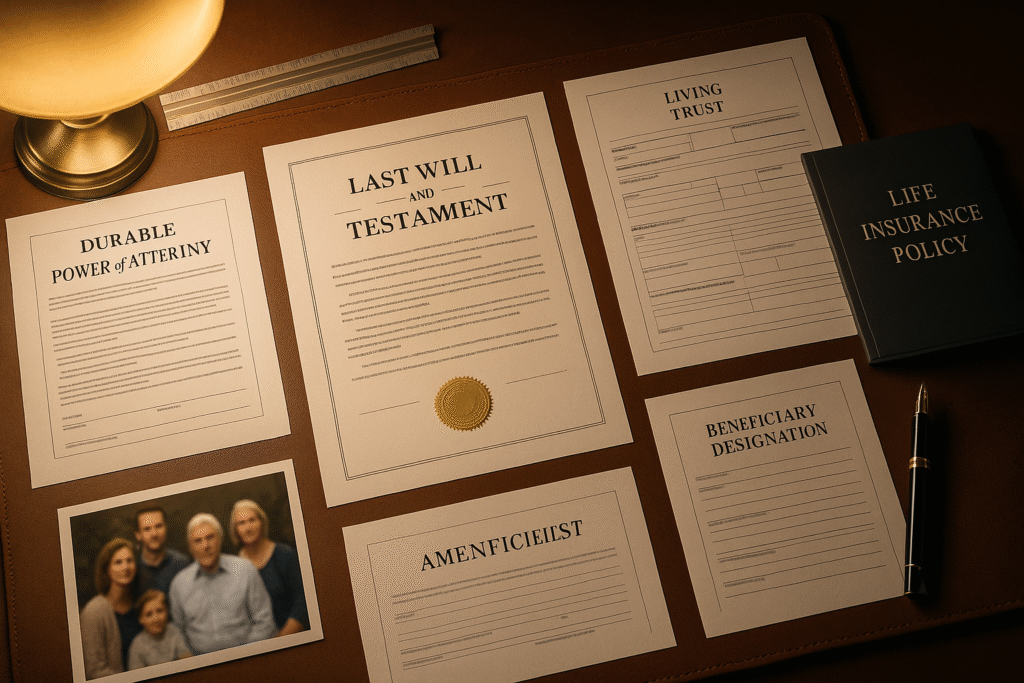

You’ve built something. Make sure it goes where you intend.

Essential documents:

- Will and/or trust — Dictates asset distribution

- Power of attorney — Financial and healthcare proxies

- Beneficiary designations — Check these annually; they override wills

Consult financial professionals who can help with estate plans to ensure your family is protected and your wishes are honored.

The Bottom Line: Your Retirement Isn’t Found — It’s Built

Most men in their 40s and 50s are told to “catch up.” That language implies you’re behind in a race with a fixed finish line.

Wrong metaphor.

You’re not catching up. You’re building momentum during your peak earning years with the strategic advantage of experience.

By implementing these strategies, you can enhance your financial security and prepare for a comfortable retirement.

The Final Truth: Retirement security isn’t about perfect planning from age 25. It’s about aggressive, intelligent action from wherever you are today.

You don’t need more time. You need better strategy, executed consistently.

The men who retire well in their 60s aren’t the ones who started earliest. They’re the ones who got serious in their 40s and 50s — and stayed serious.

Your Next 30 Days: The Financial Reset

- Week 1: Calculate your true net worth and retirement gap

- Week 2: Increase retirement contributions; create debt elimination timeline

- Week 3: Review insurance coverage; open/max out HSA

- Week 4: Schedule consultation with fee-only financial advisor

Purpose Drive: This isn’t about spreadsheets and sacrifice. This is about building the freedom to choose how you spend your 60s, 70s, and 80s.

Most men realize at 65 what they should have done at 45. You’re reading this now. That’s your advantage.

Use it.

The difference between financial stress and financial freedom in retirement comes down to decisions made in these exact years. Not perfect decisions. Just purposeful ones, executed consistently.

What you build now defines what you’ll have then. Start building.