Neurological Benefits of Pickleball: A Deep Dive

The Neurological Benefits of Pickleball Explained (2025)

Introduction

Understanding the neurological benefits of pickleball is essential for those seeking both fun and cognitive enhancement.

In recent years, pickleball has exploded in popularity, transitioning from a niche backyard game to a global phenomenon. Its appeal is often attributed to its social nature and accessible learning curve. However, a growing body of evidence reveals a much deeper benefit: its profound positive impact on the brain.

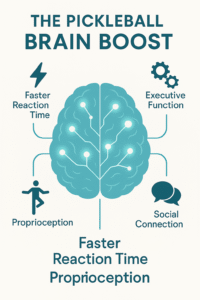

The neurological benefits of pickleball extend far beyond simple physical exercise, offering a unique combination of cognitive, motor, and social stimulation that can enhance brain health, improve cognitive function, and promote long-term mental acuity.

This article evaluates the science behind how pickleball affects the brain. We will explore the intricate relationship between the sport and concepts like neuroplasticity, proprioception, and executive function. Drawing from kinesiology and neuroscience, we will unpack how every dink, volley, and strategic play serves as a powerful workout for your neural circuits.

Whether you’re a seasoned player or simply curious about the “pickleball craze,” you’ll discover why this sport is increasingly being recognized not just as a fun pastime, but as a potent prescription for a sharper, more resilient mind.

One key aspect of the neurological benefits of pickleball is its engagement of various cognitive functions.

What is Proprioception and Why Does It Matter in Pickleball?

The neurological benefits of pickleball are increasingly being recognized by health professionals.

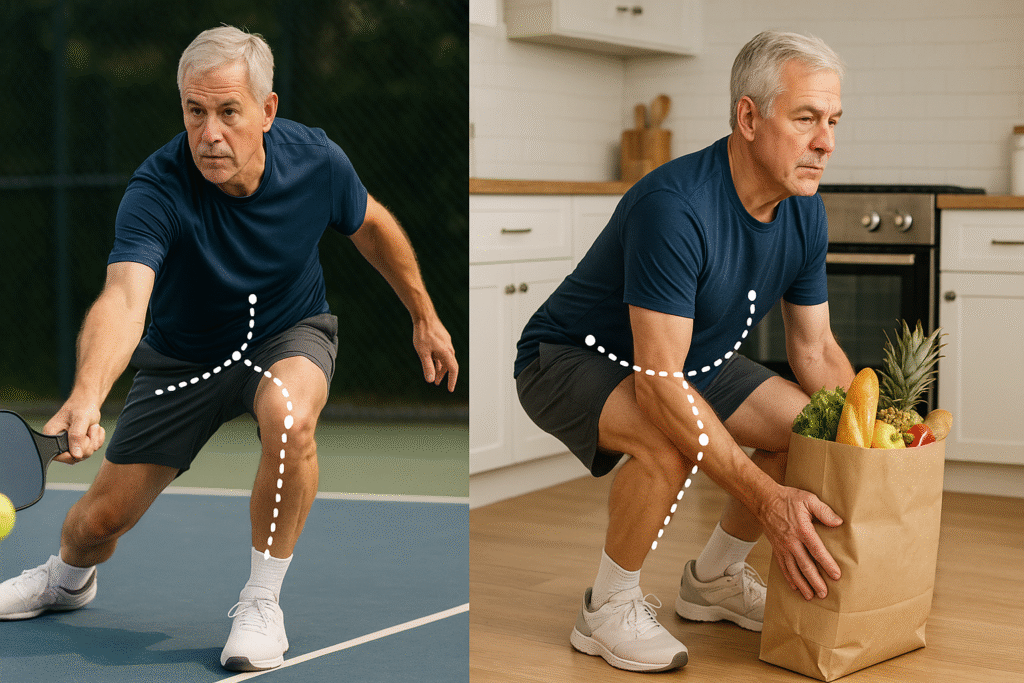

At the core of pickleball’s brain-boosting power is its ability to supercharge proprioception. Often called the body’s “sixth sense,” proprioception is your brain’s internal GPS. It is the unconscious awareness of where your body parts are in space without looking at them. As neurophysiologist Louisa Nicola states, “You cannot achieve anything without understanding where you are in space and time.” This sense is critical for balance, coordination, and fluid movement.

Pickleball constantly challenges and refines this system. Consider the following actions in a single point:

- Tracking the ball: Your brain calculates its speed, spin, and trajectory.

- Positioning your body: You shuffle your feet, pivot your hips, and adjust your stance, all while keeping your balance.

- Executing a shot: You swing the paddle to make precise contact with the ball, controlling the angle and power.

Each of these movements requires your brain to process sensory feedback from muscles and joints rapidly. Strengthening the neural pathways that govern proprioception is essential for improving on-court performance and enhancing functional mobility in everyday life.

A well-honed proprioceptive sense translates to better balance and a lower risk of falls, a crucial benefit, especially for older adults.

Alt Text: A pickleball player demonstrating good form and balance while hitting a forehand shot.

How Pickleball Rewires Your Brain Through Neuroplasticity

Recognizing the neurological benefits of pickleball can encourage more people to participate.

Exploring the neurological benefits of pickleball opens new avenues for brain health research.

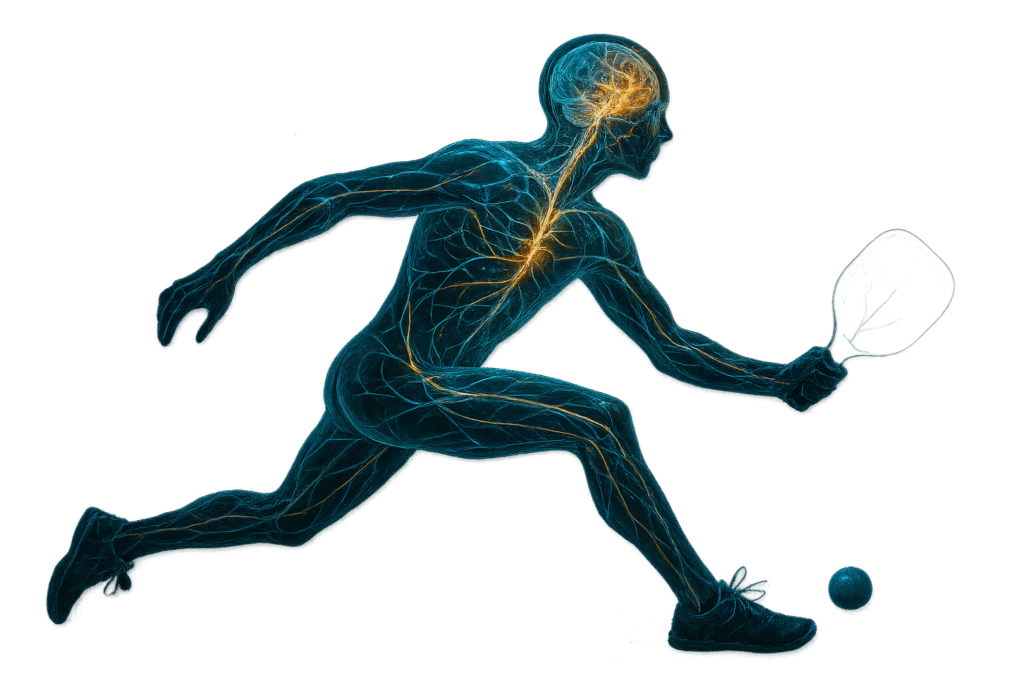

One of the most exciting neurological benefits of pickleball is its role in promoting neuroplasticity. This is the brain’s incredible ability to reorganize itself by forming new neural connections. Think of it as the brain’s capacity to learn and adapt. Activities that are novel, challenging, and engaging are potent drivers of neuroplasticity.

Countless studies are focusing on the neurological benefits of pickleball for aging adults.

Pickleball checks all of these boxes.

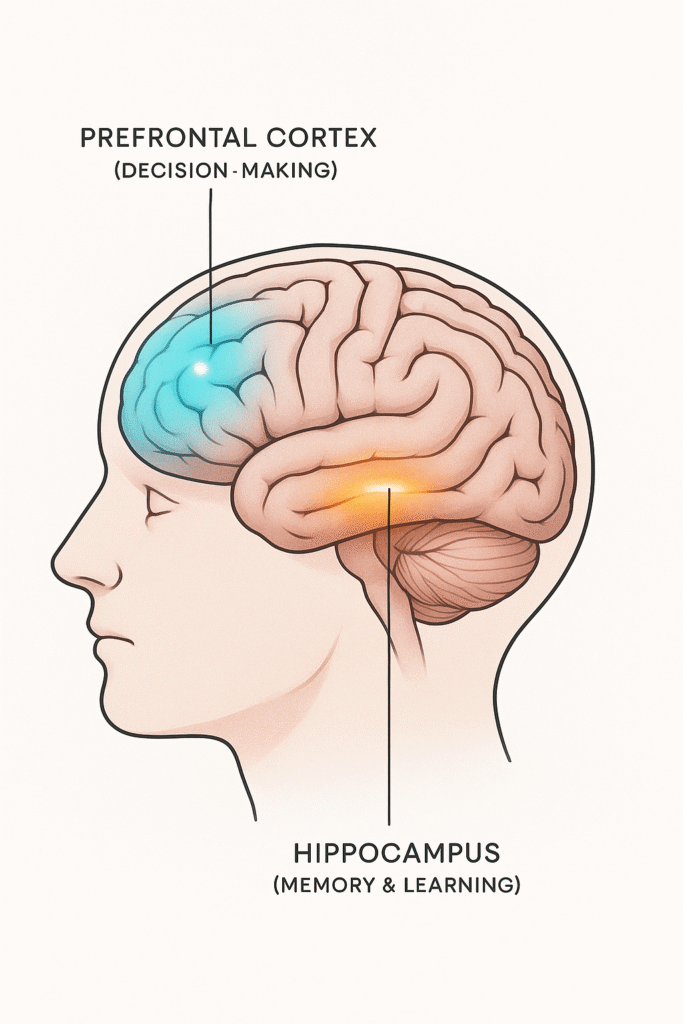

- Cognitive Demand: The sport isn’t just physical; it’s a high-speed game of chess. You must constantly analyze your opponent’s position, anticipate their next shot, and decide your strategy in fractions of a second. This rapid decision-making stimulates the prefrontal cortex, the brain’s command center for executive functions.

- Motor Learning: Mastering a new shot, like a third-shot drop or a cross-court dink, requires practice and repetition. This process of motor learning physically strengthens the connections between neurons in the motor cortex, making movements more efficient and automatic over time [4].

- Multi-Sensory Integration: During a game, your brain is flooded with information from your eyes, ears, and body. It must seamlessly integrate this data to produce a coordinated response. This complex task forces different brain regions to communicate more effectively, forging stronger and more resilient neural networks.

This “rewiring” process helps build what neuroscientists call cognitive reserve—the brain’s ability to withstand age-related changes and disease.

Engaging in cognitively demanding physical activities like pickleball is a proven way to build this reserve, potentially delaying the onset of cognitive decline [5, 6].

The Kinesiological Impact of Pickleball: More Than Just a Workout

By enhancing coordination, the neurological benefits of pickleball directly impact daily life.

The Men’s Health Over 40 Ultimate Guide to Energy, Strength & Longevity

From a kinesiology perspective—the study of human movement—pickleball is a uniquely effective form of exercise. It combines elements of aerobics, strength training, and agility drills into a single, dynamic activity.

Improved Balance and Coordination

The game’s dynamic nature requires constant adjustments in body position. The quick lateral movements, lunges for low balls, and rapid changes in direction provide excellent training for the body’s balance systems. This leads to:

- Stronger core muscles, which are essential for stability.

- Enhanced hand-eye coordination from tracking and striking the ball.

- Faster reaction times as you learn to respond instantly to fast-paced volleys.

Functional Fitness for Everyday Life

The movements in pickleball mimic many actions required in daily activities, such as squatting to pick something up, reaching for an item on a high shelf, or quickly stepping aside to avoid an obstacle. By training these movement patterns on the court, players improve their functional mobility. This is particularly beneficial as we age, helping to maintain independence and a high quality of life [9].

Table: Kinesiological Benefits of Pickleball vs. Other Activities

| Feature | Pickleball | Jogging | Weightlifting |

| Cardiovascular | Moderate to High | High | Low |

| Agility/Balance | High | Low | Low to Moderate |

| Hand-Eye Coordination | High | Low | Low |

| Social Interaction | High | Low to Moderate | Low to Moderate |

| Joint Impact | Low to Moderate | High | Low to Moderate |

This table illustrates pickleball’s unique advantage: it offers a holistic workout that challenges multiple physiological systems simultaneously with relatively low impact on the joints.

This table illustrates pickleball’s unique advantage: it offers a holistic workout that challenges multiple physiological systems simultaneously with relatively low impact on the joints.

Why Is Pickleball So Good for the Social Brain?

Humans are wired for connection. Social isolation is a significant risk factor for cognitive decline and has been linked to an increased risk of dementia [7]. This is where pickleball truly shines. Its design inherently fosters social interaction, which is vital for brain health.

Understanding the neurological benefits of pickleball provides a framework for future studies.

Understanding the neurological benefits of pickleball provides a framework for future studies.

- Proximity: The small court size keeps players close, encouraging conversation and camaraderie between points.

- Doubles Format: The most common way to play is in doubles, which requires communication, teamwork, and strategy with a partner.

- Welcoming Community: Pickleball culture is famously friendly and inclusive, making it easy for newcomers to find games and make friends.

These positive social interactions trigger the release of oxytocin, the “bonding hormone,” which has neuroprotective effects, helps reduce stress, and enhances memory.

The combination of physical activity, cognitive challenge, and social engagement creates a powerful trifecta for brain health, hitting on all the key pillars of a brain-healthy lifestyle.

Does Pickleball Prevent Cognitive Decline?

While no single activity can guarantee the prevention of diseases like Alzheimer’s, a lifestyle rich in cognitively stimulating activities is one of the best defenses. Pickleball provides a comprehensive brain workout that targets key areas vulnerable to age-related decline.

- Executive Functions: The strategy and quick decision-making involved in pickleball give the prefrontal cortex a robust workout. This area governs planning, problem-solving, and working memory.

- Hippocampal Activity: Physical exercise is known to increase blood flow to the brain and stimulate the growth of new neurons (neurogenesis), particularly in the hippocampus, a region critical for memory and learning [6].

- Dopamine Release: Learning a new skill and achieving goals on the court (like executing a perfect shot) triggers the release of dopamine, a neurotransmitter associated with reward, motivation, and learning. This reinforces the desire to play and learn, creating a positive feedback loop for brain engagement.

By consistently engaging these neural systems, players can build a more resilient and adaptable brain. This brain is better equipped to handle the challenges of aging.

Studies highlight the neurological benefits of pickleball in cognitive research, showcasing its potential as a tool for maintaining mental acuity over time.

Studies highlight the neurological benefits of pickleball in cognitive research.

Conclusion: Your Brain’s Favorite Sport

The evidence is clear: the neurological benefits of pickleball are both significant and multifaceted. This engaging sport is far more than a simple physical activity; it’s a holistic intervention for brain health.

By combining the physical demands of a racket sport with the strategic depth of a board game, pickleball offers a uniquely potent cocktail for cognitive vitality. It challenges your brain and body in a dynamic, fun, and socially rewarding environment.

References

Those who play often cite the neurological benefits of pickleball as a motivating factor.

[1] Nicola, L. (Neurophysiologist). (Interviewed in source article: The court is calling: How pickleball is rewiring brains, one volley at a time – NaturalNews.com. August 15, 2025). [2] USA Pickleball. (2020, February 17). Importance Of Balance And Proprioception In Pickleball. https://usapickleball.org/member-news/importance-of-balance-and-proprioception-in-pickleball/ [3] ChiroEco. (2025, April 22). How neuroplastic chiropractic improves patient outcomes. https://www.chiroeco.com/neuroplastic-chiropractic/ [4] Number Analytics. (2025, June 6). The Neuroscience of Motor Learning: A Capstone Guide. https://www.numberanalytics.com/blog/neuroscience-motor-learning-capstone-guide [5] Amen Clinics. (2022, February 21). 7 Surprising Ways Pickleball Benefits Your Brain. https://www.amenclinics.com/blog/7-surprising-ways-pickleball-benefits-your-brain/ [6] Crenshaw Pickleball Club. (2024, November 27). How Pickleball Boosts Your Brain, Backed by Neuroscience. https://www.crenshawpickleballclub.com/blog/blog-post-one-jbn82-gff9w-gc6rb-5z5h3-racay-9mlla-wsx4c-pnm9x-hteml [7] Journal of American Geriatrics Society. (Cited in source article: The court is calling: How pickleball is rewiring brains, one volley at a time – NaturalNews.com. August 15, 2025). [8] Mindbodygreen. (2025, August 14). The Surprising Brain Benefit Of Pickleball, From A Neurophysiologist. https://www.mindbodygreen.com/articles/brain-healthy-benefit-of-pickleball?srsltid=AfmBOoqxufsUtS2muROd48x-jdOhh1d165NntcMsSE48olCEkEfYfEW3 [9] Mayo Clinic Press. (2024, August 23). Play on, Picklers! The health benefits of pickleball.The combination of physical activity and the neurological benefits of pickleball creates a lasting impact.

Ultimately, the neurological benefits of pickleball cannot be overstated.

Join the movement and explore the neurological benefits of pickleball today!

Pickleball is not only about fun but also about realizing the neurological benefits of pickleball.

Join the movement and explore the neurological benefits of pickleball today!

Table of Contents

Join the movement and explore the neurological benefits of pickleball today!